Top Mutual Fund Mistakes to Avoid in 2025

Top Mutual Fund Mistakes to Avoid in 2025: A Simple Guide for Smarter Investing

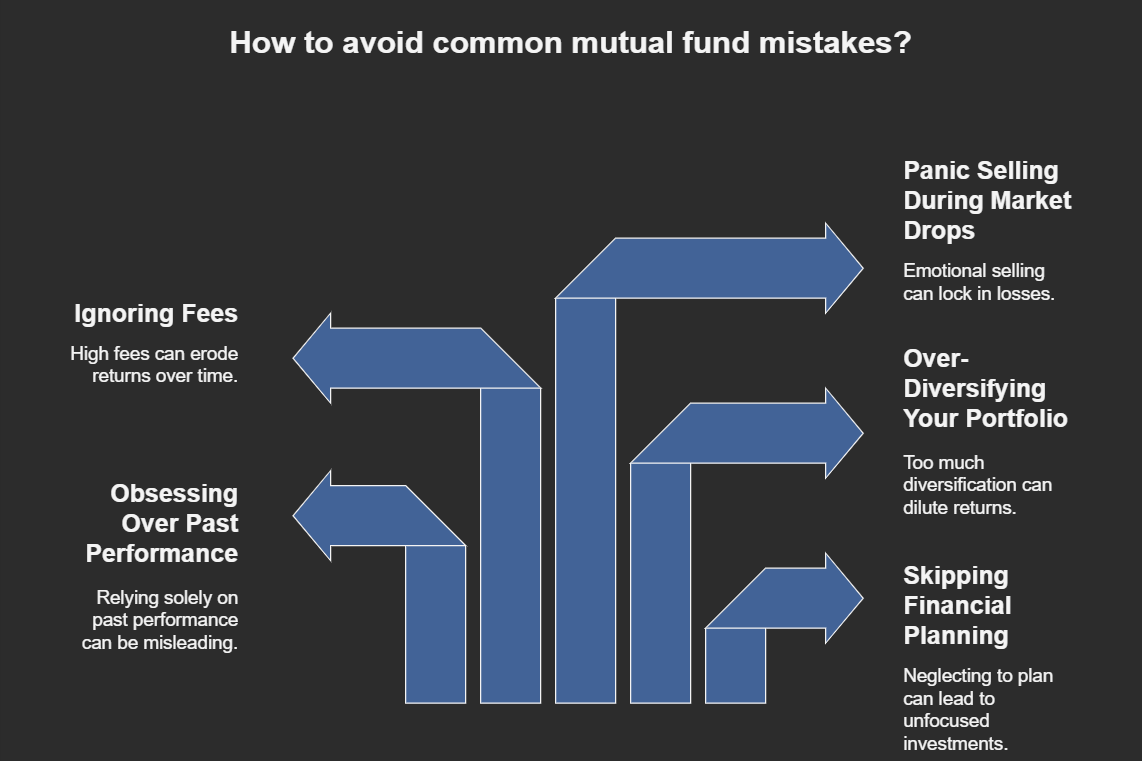

Mutual funds have become a go-to investment choice for many Indians, thanks to their potential for solid returns and ease of use. But like any investment, mutual funds come with pitfalls. Making rushed or uninformed decisions can hurt your returns. To help you invest wisely, here’s a list of common mutual fund mistakes to avoid—and how to fix them.

1. Skipping Financial Planning

Mistake: Jumping into mutual funds without a clear plan is like driving without a map. Many investors pick random funds without understanding their own financial goals, emergency savings needs, or risk tolerance. In fact, SEBI reports that 90% of investors in India withdraw their mutual fund investments within three years, often due to panic during market swings.

Solution: Start by assessing your entire financial picture. List your income, debts, short-term needs (like a vacation), and long-term goals (like retirement). Tools like emergency funds (3–6 months of expenses) act as a safety net, so market dips don’t force you to cash out early. If planning feels overwhelming, consult a financial advisor to align your investments with your goals.

2. Obsessing Over Past Performance

Mistake: Choosing funds only because they did well last year is risky. For example, a fund that soared over three years might not repeat that success. Past performance doesn’t guarantee future results.

Solution: Look beyond returns. Check the fund’s consistency (does it perform well in good and bad markets?), the fund manager’s experience, and risk metrics like the Sharpe Ratio. Think of it like hiring a chef: you’d want someone who cooks great meals reliably, not just once.

3. Over-Diversifying Your Portfolio

Mistake: Spreading money across too many funds can backfire. In India, 60% of equity mutual funds invest in the same Nifty 50 stocks. Holding 10 large-cap funds? You’re likely just duplicating investments and paying extra fees.

Solution: Keep it simple. Pick 4–6 funds across categories (e.g., one large-cap, one mid-cap, one debt fund) that match your goals. Quality over quantity!

4. Ignoring Fees (Expense Ratios)

Mistake: High fees eat into your returns. Regular mutual funds (sold through agents) charge 1-2% annually, while direct plans cost less (0.5-1%). Over 10 years, a 1% difference can cut your final returns by lakhs.

Solution: Always compare expense ratios. Choose direct plans via platforms like Coin by Zerodha or Groww. Index funds (which mimic market indexes) are even cheaper (0.05–0.2% fees) and often outperform active funds.

5. Falling for New Fund Offers (NFOs)

Mistake: NFOs (New Fund Offers) lure investors with low ₹10 NAVs, but they’re not bargains. Unlike IPOs, NFOs lack a track record, often have hidden fees, and may invest in the same stocks as existing funds.

Solution: Skip NFOs unless they offer something truly unique (e.g., a new theme like AI or EVs). Stick to established funds with proven strategies.

6. Panic Selling During Market Drops

Mistake: Selling in a downturn locks in losses. Many investors bail when markets dip, missing the eventual recovery.

Solution: Stay calm and stick to your plan. Mutual funds are long-term investments. If volatility stresses you, opt for balanced or hybrid funds that mix equity and debt for stability.

7. Forgetting About Taxes

Mistake: Taxes vary by fund type. Equity funds held over a year face 10% tax on gains above ₹1 lakh. Debt funds held over three years are taxed at 20% with indexation.

Solution: Plan withdrawals strategically. Hold equity funds for over a year to qualify for lower taxes. Consult a tax advisor to optimize your returns.

8. Avoiding SIPs

Mistake: Lump-sum investing risks buying at a market peak.

Solution: Use SIPs (Systematic Investment Plans). Investing fixed amounts monthly averages out costs and builds discipline. For example, ₹5,000 monthly in a fund averaging 12% returns can grow to ₹1.2 crore in 25 years!

9. Not Reviewing Your Portfolio

Mistake: Letting your portfolio gather dust can leave you stuck with underperforming funds.

Solution: Review your funds yearly. Compare their performance to benchmarks (like Nifty 50). If a fund lags for 2–3 years, consider switching.

10. Following the Crowd

Mistake: Investing in trendy funds because friends or media hype them up.

Solution: Your goals and risk tolerance are unique. A small-cap fund might suit your neighbor but could be too volatile for you. Do your research or ask a financial advisor.

Bonus Tips

- Understand Fund Types: Equity (stocks), debt (bonds), and hybrid (mix) funds serve different purposes. Pick ones that align with your goals.

- Check Exit Loads: Some funds charge fees if you withdraw early. Always read the fine print.

Also read : What’s the Biggest Mistake That Stock Market Investors Make?

Final Thoughts

Mutual funds can grow your wealth, but avoiding these mistakes is key. Start with a plan, keep fees low, stay patient, and review regularly. When in doubt, seek advice from a certified financial planner.

FAQ

Q1: Are index funds better than active funds?

A: For most investors, yes! Index funds have lower fees and often match or beat active fund returns over time.

Q2: How much should I invest via SIP?

A: Start with what you can afford—even ₹500/month. Increase as your income grows.

Q3: Can I lose all my money in mutual funds?

A: While risk exists, diversification across fund types reduces this. Avoid putting all your money in high-risk equity funds if you need it short-term.

2 thoughts on “Top Mutual Fund Mistakes to Avoid in 2025”