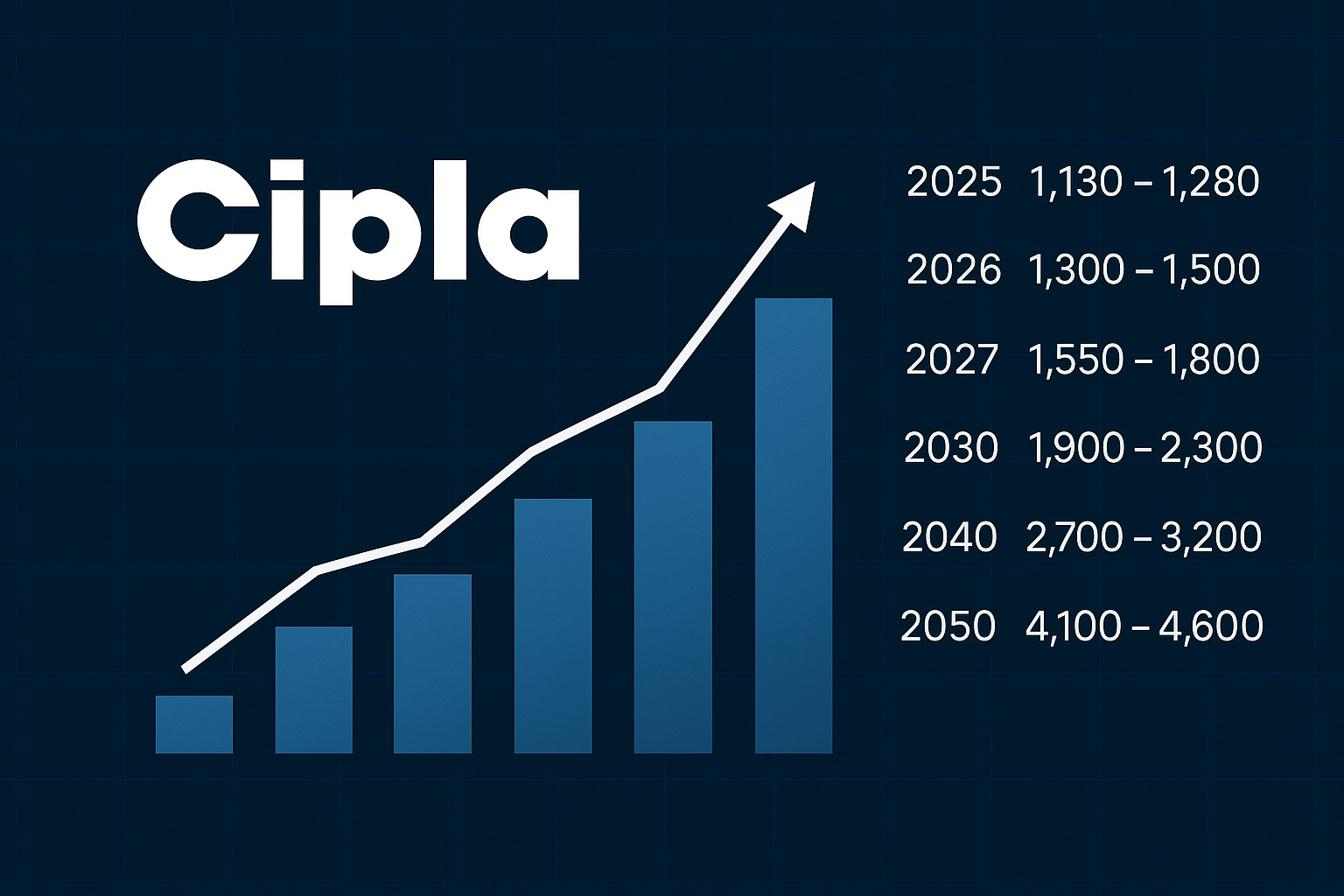

Cipla Share Price Target For 2025, 2026, 2027, 2028, 2029, 2030, 2035, 2040, 2045, 2050

Cipla Share Price: Profile Summary of Cipla

Cipla Limited is a leading pharmaceutical company in India, established in 1935. It is well reputed for manufacturing generic medicines along with the active pharmaceutical ingredients (APIs). Cipla offers medicines for various therapeutic segments like, Respiratory, Cardiovascular, Anti Infective and Oncology. The company has a strong global presence, supplying medicines to over 80 countries.

Product and Service Offering of Cipla

Cipla has manufactured and sold a variety of pharmaceutical products. Major groups are:

- Respiratory Medicines – Inhalers and nebulizers for Asthma and COPD patients.

- Cardiovascular Drugs – Anti hypertensives and Antihyperlipidemics.

- Oncology Drugs – Cancer treatment medications.

- Anti Infectives – Antibiotics and antiviral drugs

- Diabetes Management – Insulin and oral diabetic medications.

Market Presence

Strong Presence in India and Around the Globe.

- India: Being one of the major pharmaceutical companies in India, Cipla has maintained a longstanding reputation and a wide distribution network.

- Global Markets: The company exports such medicines to the US, Europe, Africa, and Latin America.

- Research and Development: With modern manufacturing plants, Cipla invests heavily in the r&d of new drug formulations.

Financial Performance

Cipla has demonstrated an uninterrupted financial progress over the two decades:

- Revenue Growth: Sustained revenue growth supports selling through the local and international markets.

- Profitability: Steady profit margins owing to low-cost manufacturing activities and high market demand.

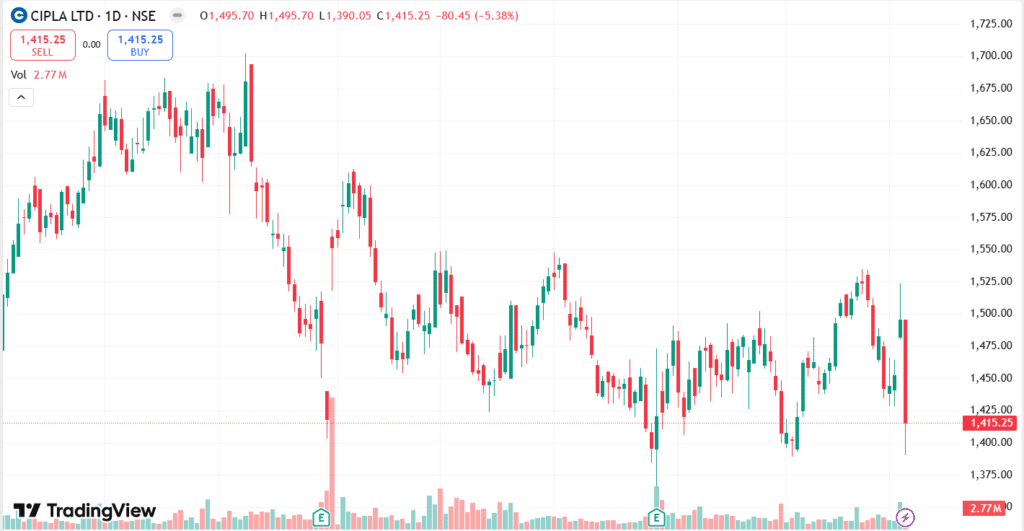

- Stock Market Performance: Cipla shares are traded on the BSE and NSE and are considered for selection because of stable performance.

Future Growth Prospects

Cipla is deemed to grow continuously on the basis of the following:

- Medicines are easy to obtain: An aged population increases the need for healthcare.

- New and Emerging Markets: Greater sales in developed and emerging regions.

- Strategic Focus on Innovation: Strong focus on innovation and new generic drug develops.

- Government policies and increase of spending on public healthcare.

Key Growth Drivers for Cipla

- Strong Presence in Generic Medicine Market

- Expansion in US and Europe

- Focus on Specialty Drugs and Biologics

- Growing Demand for Respiratory and Cancer Drugs

- Government Support for Affordable Healthcare

Cipla Share Price Target for Different Years

Cipla Share Price Target for 2025 -Month

| Month | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| January | 1,100 | 1,150 |

| December | 1,200 | 1,250 |

Cipla Share Price Target for 2026

| Month | Minimum Target (₹) | Maximum Target (₹) |

| January | 1,250 | 1,300 |

| December | 1,350 | 1,400 |

Cipla Share Price Target for 2030

| Month | Minimum Target (₹) | Maximum Target (₹) |

| January | 1,800 | 1,900 |

| December | 2,000 | 2,100 |

Cipla Share Price Target for 2040

| Month | Minimum Target (₹) | Maximum Target (₹) |

| January | 3,500 | 3,700 |

| December | 3,900 | 4,100 |

Cipla Share Price Target for 2050

| Month | Minimum Target (₹) | Maximum Target (₹) |

| January | 5,000 | 5,300 |

| December | 5,500 | 5,800 |

Cipla Share Fundamental Analysis

| Parameter | Value |

| Market Capitalization | ₹1.2 Lakh Crore (Approx.) |

| P/E Ratio | 28.5 |

| Earnings Per Share (EPS) | ₹42.50 |

| Dividend Yield | 0.75% |

| Revenue (TTM) | ₹40,000 Crore (Approx.) |

| Net Profit Margin | 12% |

| Return on Equity (ROE) | 15% |

| Debt-to-Equity Ratio | 0.2 |

Cipla Shareholding Pattern -Category

| Category | Shareholding (%) |

| Promoter Holding | 33.64% |

| Foreign Institutional Investors (FII) | 24.12% |

| Domestic Institutional Investors (DII) | 19.28% |

| Public & Retail Investors | 22.96% |

Also Read : Syncom Formulations Limited Share Price Target 2025, 2030, 2035, 2040, 2045, 2050

Conclusion

Cipla is a promising name in the pharmaceutical industry that has sustained growth prospects. The company’s generic products, newer drug developments alongside their global outreach makes them one of the best possible investment options. Long term investors looking to grow their portfolio may find value in Cipla stocks.

Disclaimer: The target price per share on this article is purely the outcome of calculated estimates and analyses. Nothing within them stands as predictions. Do independent research or speak to a professional financial consultant before making any investment decisions. The stock market is volatile, and risk is always involved. Achievements in the past does not guarantee assurance in the future. Ensure proper assessment before participating.

FAQs

1.What is the Cipla Share Price Prediction for 2025?

The Cipla share price is expected to be between ₹1,100 to ₹1,250.

2.What is the Cipla Share Price Prediction for 2030?

The Cipla share price is expected to be between ₹1,800 to ₹2,100.

3.What is the Cipla Share Price Prediction for 2040?

The Cipla share price is expected to be between ₹3,500 to ₹4,100.

4.What is the Cipla Share Price Prediction for 2050?

The Cipla share price is expected to be between ₹5,000 to ₹5,800.

This design is steller! You most certainly know how to keep a reader amused. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Wonderful job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!