Top Textile Stocks In India

Top Textile Stocks In India

Food, shelter, and clothing are the essential needs of a person. In the modern age, clothing is not only a requirement but also a mark of style. Indian and global brands such as Allen Solly, Van Heusen, H&M, and Levi’s have fuelled the growth of the textile sector in India.

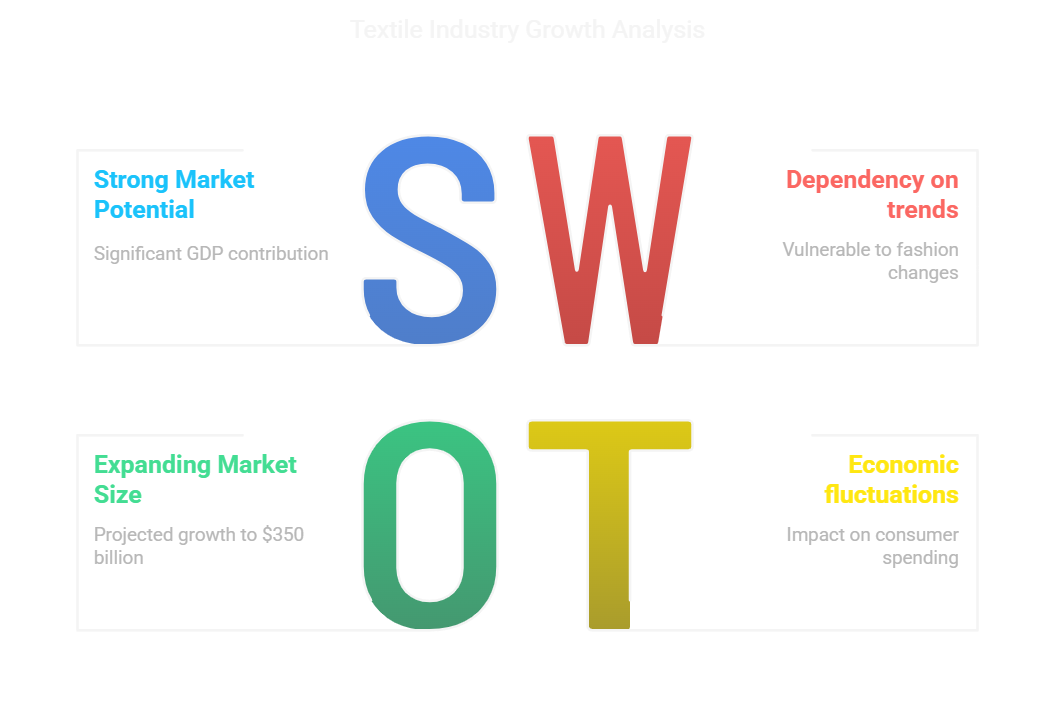

As of now, the textile and apparel industry adds approximately 2.3% to the GDP of India. Experts forecast that it will rise to about 5% by 2030 with the market poised to reach $350 billion.

CRISIL has predicted that the retail apparel industry will grow by 8-10% in the upcoming financial year. This blog post aims to provide information on the top textile stocks in India for investors interested in capitalising on the growing industry.

What Are Textile Stocks?

Textile stocks are the shares of companies that are engaged in the manufacturing and selling of textiles and garments. These businesses deal with cotton and synthetic fibres, silk, and even home textiles. Among the best textile stocks in India are the following:

- Raymond

- Vardhman Textiles

- K.P.R. Mill

- Welspun Living

- Arvind Ltd.

- Trident Ltd.

The performance of the textile stocks gets impacted by a variety of factors including the prices of the raw materials, export demand, policies from the government, and fashion tendencies. It is imperative to ask the question: can textile stocks beat the Nifty 50 index? Let us examine the growth prospects of the industry.

An Overview of Indian Textiles

The Indian Textile Sector is one of the most important in terms of the country’s GDP, exports and employment opportunities. India also stands to gain from some geopolitical shifts in international trade such as the US-China Trade War and political upheaval in Bangladesh which bodes well for the future of India’s textile industry.

The group advances contribute

- The IT Industry contributes 2.3% to the Indian GDP, 13% of industrial production, and 12% of Indian exports.

- India’s textile exports are expected to increase from $65 billion to $100 billion by 2026 and 2030 respectively.

- India became the top cotton producer in 2023-24 with expected production of 32.3 million bales.

- The sector has witnessed $4.47 billion in FDI since 2000, and is allowed 100% FDI under the automatic policy route.

In the upcoming years, the Indian textile industry is bound to experience significant growth because of increased demand, robust government support, and the growth of global markets.

Value Chain of the Textile Industry

With investment opportunities in textile stocks ready for grabs, the textile industry has multiple stages from production of raw materials to selling directly to the consumers.

| Stage | Key Activities |

|---|---|

| Raw Material Sourcing | Cotton, jute, wool, silk, and synthetic fiber production |

| Ginning & Spinning | Processing raw cotton into fibers and spinning fibers into yarns |

| Weaving & Knitting | Converting yarn into fabric through weaving or knitting |

| Processing & Dyeing | Bleaching, dyeing, and finishing fabrics |

| Garment Manufacturing | Cutting, stitching, and finishing garments for sale |

| Distribution & Retail | Selling through stores and online platforms |

| Exports & Trade | Exporting textiles to international markets |

Growth reasons for investing in textile stocks:

- Growth of Industry

Underlying consumption drivers include rising income levels, urbanisation, and more diverse fashion trends driving higher domestic consumption.

- Government Backing

Support from the government and ministries through initiatives like PM MITRA mega textile parks and Manufacturing-Linked incentive schemes boost manufacturing and exports.

- Growth of Export

India ranks 3rd in the world for the exportation of textiles and clothes, claiming 4.6% of the global market share.

3 Textile Stocks Predictions for 2025 Still Relevant Today

Arvind Limited is the leading textile firm in the country as it manufactures denim, woven fabrics, knits, and advanced materials, and also caters to global brands such as Arrow, U.S. Polo Assn., and Tommy Hilfiger.

Q3 FY25 Performance –

- Revenue was up 10% YoY

- Net profit has also seen an uptick of 12% YoY

- Improvement in debt-to-equity from 0.91 (FY20) to 0.37 (FY24)

- Arvind Ltd. is increasing garment production capacity plans to 49 million by FY26.

Vedant Fashions Préndre is a one stop shop for Indian wedding and festive wear under the Manyavar label. The operations of the franchisee owned stores follow an asset light model.

Q3 FY25 Performance –

- Revenue climbed to 7.8% YoY

- Monthly consumer spending slowdown saw profits flat at 0.2% YoY

- The company holds no debt and has growing cash flow

Though there are bound to be temporary eases, Manyavar remains a strong brand for long-term consideration.

Vardhman Textiles is among the largest manufacturers of Indian textiles including yarn, fabric and apparel.

Q3 FY25 Performance:

- Revenue increased by 5% YoY

- Net profit surged 26% YoY

- Debt-to-equity ratio reduced from 0.78 (FY15) to 0.20 (FY24)

Vardhman Textiles seems to be a good investment considering its weak valuation comparatively against the average in the industry along with healthy finances.

Also Read : How Health Insurance Can Protect Your Finances During Retirement

Conclusion

The textile industry in India is set to climb as domestic demand, government schemes, and exports are on the rise. There are some problems with competition and fluctuating raw material prices, but there can be great innovation by firms focusing on sustainable practices.

Evaluate your investment risks and financial objectives before making a decision. For those looking to diversify their portfolio further, check out our blog about top automobile stocks in India.

Happy Investing!

3 thoughts on “Top Textile Stocks In India”