Microsoft Share Price – Current Trends, History & Future Outlook

Introduction

Microsoft stands tall as among the elite technology corporations globally. Products such as Windows, Microsoft Office, Azure, and Xbox Positions them in the limelight as foremost industry leaders. Moreover, the Firm is also listed on the NASDAQ stock exchange with the MSFT ticker symbol.

As with other businesses, tracking stock prices Microsoft shares are equally important, and whether they represent promising investment opportunities. This blog will assist you comprehend the Microsoft stock price, historical movement, and future projections and trends Microsoft’s in simpler terms.

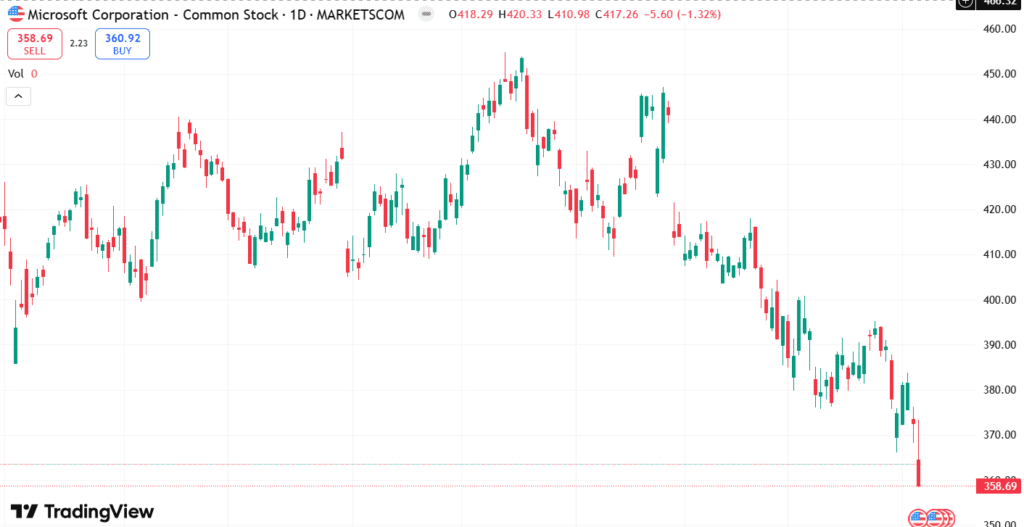

Microsoft Share Price Today

Microsoft share price today stands at approximately: $358.69USD. Current stock prices are altered by markets, company’s performance, and news worldwide.

Live prices can be checked at:

- Yahoo Finance

- Google Finance

- Bloomberg

- TradingView

Microsoft Share Price History

Here’s a quick look at how Microsoft stock has performed in the past:

| Year | Share Price (Approx.) | Notes |

|---|---|---|

| 2010 | $30 | Slow growth period |

| 2015 | $45 | Cloud services started growing |

| 2020 | $160 | Boost during COVID tech demand |

| 2023 | $300+ | Strong earnings, AI focus |

Due to the increase in cloud computing and AI advancements, Microsoft’s shar prices have surged tremendously over the years.

What Influences Microsoft Share Price Up and Down?

Here are some factors that can influence the price of Microsoft’s stock:

✅ Company Earnings – Strong profits = price increase

✅ New Product Releases – Deployment of new features like AI tools, cloud services updates.

✅ Global Events – Changes and shifts to the economy, increase in the rate of interest and inflation.

✅ Actions from Rival Companies – Moves made by Apple, Google, Amazon, etc.

✅ Investor Sentiment – Overall perception of the market.

Microsoft Purchasing Opportunities or the Good Investment?

Microsoft is considered a blue-chip stock. This means the company is strong, stable, and Microsoft shares will continue increasing in value. Primary reasons to invest in Microsoft are: Good Microsoft brand recognition.

- Coming up and retaining dividends and profits.

- Continuously leading in innovation in artificial intelligence, cloud computing, and other software.

- Having a reliable environment with solid governance under Satya Nadella as the CEO.

Always conduct personal Microsoft investment research (DYOR) or speak with a trustworthy financial expert before continuing.

Forecasting Microsoft Prices Shares

Market analysts have mostly positive predictions about the company. Here’s what Microsoft experts are saying:

📌 Short-Term: Expectable and expected minimal gains and losses from Microsoft due to market volatility.

📌 Long-Term: Expected growth because of AI, Azure cloud, and consistent earnings.

Some experts argue that MSFT stock will increase to between 400and400and450 in the next 1-2 years if the trend persists.

Also Read : Mazagon Dock Share Price – Latest Updates, Analysis, and Future Outlook

Final Thoughts

Microsoft has performed well over the last 10 years and is still a favorite among investors. The company has a promising future due to its focus on cloud computing and AI.

Always check the following before investing:

- Latest share price

- Company news

- Market news

- Expert insights

FAQs

Q1. What is the stock symbol for Microsoft?

Microsoft is traded under the symbol MSFT at the NASDAQ stock exchange.

Q2. Does Microsoft issue dividends?

Yes, Microsoft consistently pays dividends to their investors.

Q3. Is Microsoft a safe investment?

Microsoft is deemed a proven and trustworthy company, but every investment has some level of risk involved. Do your homework first.

Disclaimer

The details shared in this blog is intended only for educational purposes and should not be seen as financial or investment advice. Always do your own research and seek advice from a licensed financial advisor before proceeding. Investing in the stock market involves risks and should be approached with caution; previous results do not assure future outcomes. We claim no responsibility neither for any neglect nor the outcomes of investment dependent on the information given in the blog.