How Health Insurance Can Protect Your Finances During Retirement

How Health Insurance Can Elevate Your Finances Even Years Down the Line

Introduction

Retirement is best enjoyed along the beautiful beaches, cruising the calm waters of the ocean, for an individual who has had the pleasure of fulfilling all their monetary requirements. But their peaceful existence can in fact be disrupted by skyrocketing healthcare costs. These requirements need to be planned for well in advance with a reliable health insurance policy. We are going to inform you about all this in detail later in the following sections.

Why Health Insurance is Vital for Retiree’s

- Unreasonable Medical Costs:

Due to the ever changing dynamics of society nowadays, the availability of healthcare services has now become an increasing market – making it more expensive every day. Health insurance plans can become extremely valuable in these times as they actively cover expensive hospital stays, consultations, and medications, allowing retirees to hold on to their savings.

- A Greater Risk of Severe Health Issues:

As time passes, the probability of chronic health conditions like diabetes, arthritis, and heart issues tends to become more prevalent among people. It is for this reason that having health insurance plans become increasingly remarkable and ensure that retirees get satisfactory treatment without worrying about the costs.

- Limited Income After Retirement

The primary income sources after an individual’s retirement include pensions, savings, and investments. Finances can become strained with unfortunate medical emergencies. Health insurance provides adequate financial protection, covering necessary medications and preserving savings.

Your Health Plan Checklist will include:

- Comprehensive Coverage

You may select a policy with complete hospitalisation, outpatient treatment, pre-existing diseases, and home care. This offers shielding for all vital healthcare expenditures.

- Lifelong Renewability

Various insurance cover policies maintain an age limit for renewal. It is always best to opt for policies with no age limits on renewability so that one can continue receiving coverage into their later years.

- No Claim Bonus

A no-claim bonus is offered by many insurers where the insured amount is increased every year claim-free. This is a valuable benefit for retired individuals needing heightened coverage at no additional cost.

- Pre-Existing Disease Coverage:

Most retirees would have some level of pre-existing medical conditions. Opting for a policy with a short waiting time and extensive cover for pre-existing diseases is vital to avoid high medical costs.

- Home Treatment Benefits

Some long-term health conditions require round-the-clock domiciliary care. Policies with domiciliary care benefits allow retirees to receive treatment at their residence, greatly reducing the need for hospital visits and associated costs.

How Health Insurance Protects Retirement Savings

- Avoids The Use Of Savings

Retirees spend a lifetime saving up only to deplete their savings due to sudden medical emergencies needing habitual treatments. Health insurance ensures hospital admissions along with treatment are covered which saves the retiree from dipping into their savings.

- Lessens Out Of Pocket Spending

Policy holders are often entitled to cashless hospitalisations and treatment policies which frees up a lot of money for retirees.

- Provides Tax Deductions

Expenses such as health insurance are tax-deductible under the health insurance tax scheme section 80D. Financially planning for retirement is made easier since retirees who are above 60 are able to claim a whopping ₹50000.

- Provides Coverage For Chronic Disease Cost

Chronic illnesses come with their own set of expenses in the form of doctors, medications, and countless tests needed to be done with every visit. The right health insurance policy alleviates some of this burden by taking care of these expenses.

Government Funded Health Insurance Aid Available For Seniors

PMJAY is aimed at assisting lower income retirees and the elderly by providing up to ₹5 lakh per family a year for hospitalisation expenses.

Numerous dedicated insurers focus on health plans for senior citizens treating age-induced illnesses, allowing for coverage of pre-existing conditions, along with private nursing care.

- State Funded Health Insurance Schemes For The Elderly

A few states have introduced these schemes allowing lower premium rates with added coverage. The aim is to reduce the financial stress on senior citizens.

How to Select the Right Health Insurance Plan

- Evaluate your healthcare requirements

Analyse your medical history along with pre-existing conditions to select a plan customised to your healthcare needs.

- Review Policy Benefits

Use online comparison tools to analyse different policies and make a selection according to coverage, inclusions, waiting periods, and premium prices.

- Check Cashless Hospital Network Under the Policy

Pick a policy that offers a wide network of cashless hospitals to allow easy access to quality medical care without the need to make any initial payments.

- Determine an Adequate Sum Insured

Due to the increasing cost of medical care, it is recommended to select a policy with sufficient coverage to ensure that full cover is provided for treatment, especially for significant medical procedures and emergencies.

Also Read : Top Textile Stocks In India

Conclusion

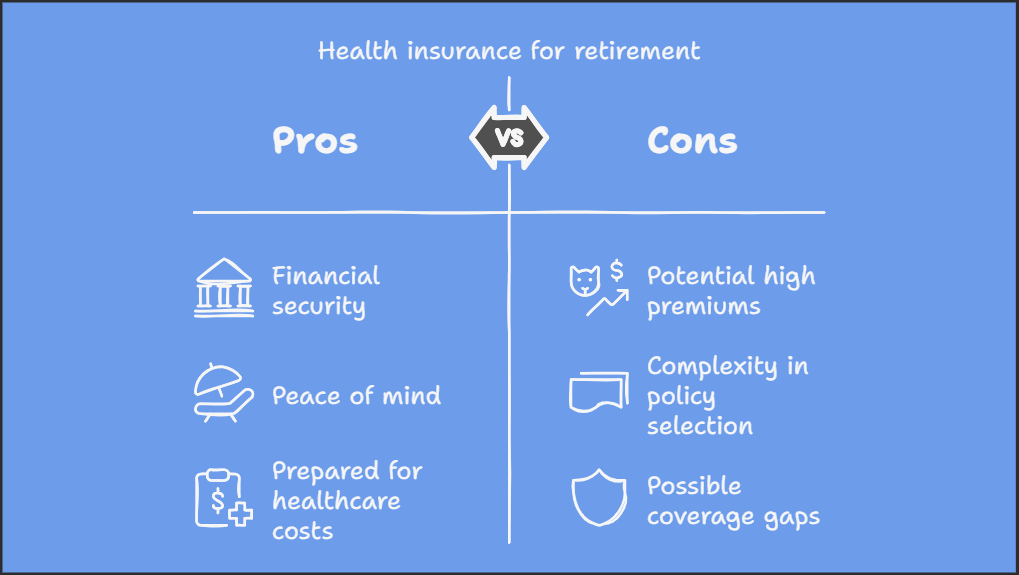

Health insurance is a vital part of one’s financial plan especially when it comes to retirement. It spares retirees the burden of increased healthcare costs and safeguards their finances. Selecting the most appropriate health plan allows retirees to maintain their health and savings, making retirement less worrisome. Investing in health insurance is more than just having protection in case of medical emergencies, it’s about financial autonomy and tranquillity.

One thought on “How Health Insurance Can Protect Your Finances During Retirement”